You will find numerous ways to accessibility your residence security without to really promote the home. Contrary financial, family equity finance, and domestic collateral lines of credit (HELOC) is actually three novel possibilities that are appropriate in various activities. This article will help you learn and this alternative would be best for you.

Opening Guarantee: Cashing For the Into Worth You Centered

One of the leading benefits associated with homeownership is that your monthly commission would go to possession, or guarantee, on your own assets. That security usually means the latest percentage of the house’s resale really worth you’ll receive for people who offer. However, you to definitely equity isn’t only regarding the choosing a good return on the disregard the when you sell your residence. You can power your own guarantee even though you never plan to offer any time soon.

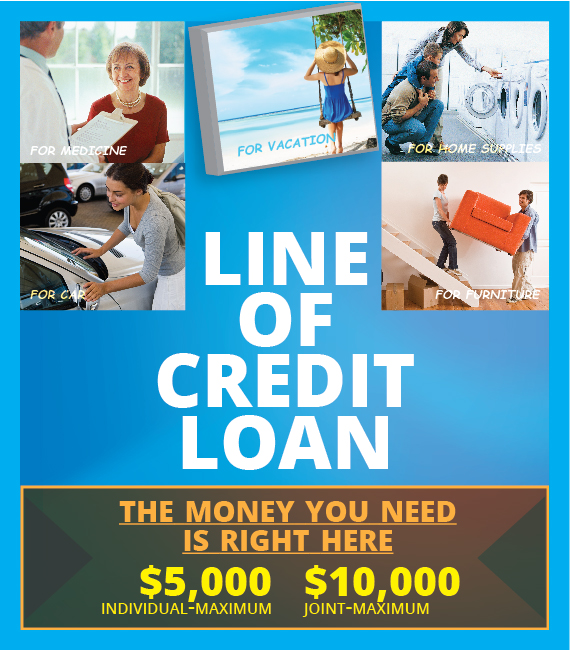

There are an approach to make the most of the brand new guarantee you’ve built up of your property. This type of generally are in the type of mortgage products which is offer loans to have sets from retirement in order to getaways, household renovations, if you don’t discretionary expenses. Prior to you have made as well happy, it’s vital to understand that every one of these choices, for instance the three we’ll stress in this article, comes with its own rules, criteria, and you may limitations.

Such financing activities and are not offered to the people. You will want to keep good-sized equity-about 20%-before you be eligible for an excellent HELOC otherwise house equity financing, meaning brand new people generally can’t instantly start borrowing contrary to the value of its residential property. Some of the certification standards be much more certain, and additionally decades and you will everything you intend to perform into currency you get. All of this means it’s essential to like meticulously after you choose which device you use to power brand new collateral on your household.

Opposite Mortgage compared to. HELOC against. Home Collateral Financing: Conditions and you will Insights

Let’s review the differences anywhere between reverse mortgage loans, domestic collateral personal lines of credit (HELOC), and you may home guarantee funds. This will help you see and therefore ones around three preferred choice, or no, try best for you.

Reverse Mortgage

- Applicants must be many years 62+

- Your house in question need to be your primary home

- Your property should be possibly paid or nearly truth be told there-criteria based on how far security you own can differ

- The home needs to be when you look at the good resolve and also have hired their worthy of

A contrary home loan are a substitute for promoting your house-it is a means of allowing seniors to remain put in the belongings it love and also have accessibility the value loans Shelton CT of the new qualities that they have while they are real time.

Contrary lenders don’t need monthly payments. Instead of typical monthly obligations, the bill of your own mortgage happens owed in the event that homeowner vacates the property, if or not on account of promoting the home, passing away, otherwise getting a different number one household.

You can utilize the funds from an opposing mortgage since you look for fit. We make use of these financing to invest in its senior years, regardless if it’s best to features almost every other resources of cash on hands plus those gotten due to a contrary home loan.

Domestic Security Financing

- A good credit score-the greater, the higher the probability was away from qualifying to have a property equity financing which have favorable terms and conditions

- Self-confident fee history for the borrowing from the bank membership together with your home loan (i.elizabeth., no present skipped repayments)

- A great personal debt-to-earnings proportion

- You’ll want accumulated no less than 20% equity throughout the possessions

- Family collateral loans also are referred to as next mortgage loans once the they function much like an elementary financial, like the fact that house collateral finance features specific payback terms and are shielded because of the property by itself

Domestic Collateral Credit line (HELOC)

HELOCs function as rotating credit lines like credit cards, definition they may not be an additional mortgage taken out along with your home because collateral.