You can also be considered if for example the credit score has expanded being large than it was once you removed investment

To track down a fundamental notion of just how a beneficial re-finance make a difference to the latest month-to-month mortgage payment, it’s best to fool around with a good refinance calculator. Just input some basic factual statements about your goals, latest home loan, your location discover in addition to consumer loan Michigan usa your credit score, and you might instantaneously be able to estimate what your refinance fee could seem like.

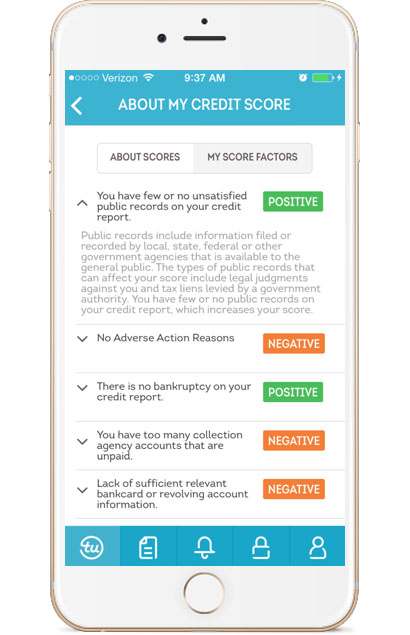

The importance of Your credit score

Your credit rating was a numerical expression regarding how good your perform obligations. If for example the rating was large, it ought to be as you always help make your home loan repayments so you can the fresh agenda thus dont receive money. In addition, if your get is reasonable, odds are since you find it very difficult speaing frankly about obligations.

A home loan is a type of financial obligation. Lenders look at your credit score just before they offer your a keen interest rate while they would like to know exactly just how legitimate you may be as a borrower. When you have a higher get, youre statistically less likely to want to forget a payment or get into foreclosures. Hence their lender takes a reduced amount of a threat once they capital your finances and will give you shorter interest costs. If your score was all the way down, it means there’s increased opportunity that you may possibly maybe maybe not invest right back what you and acquire. Your own financial have to do the chance it accept providing your own enhanced rate of interest on your own mortgage.

Thankfully that and come up with your property loan costs on the date month-to-month grows your credit score. For individuals who haven’t appeared upon brand new score to have this new some time, you’re set for an excellent wonder. Look at the number and you may contrast them to the score when you have had the borrowed funds. Once they higher than just these people were once you utilized, you might want to find a good refinance.

When Rates Is sensible

The best minutes in order to reassess how to get a loan Geneva their economic happens when rates of interest into the lenders rather liberate regarding. Its interest rate performs a massive area throughout the amount of money that you finish investing your property. If you would signed on a loan throughout the a period of time whenever prices is highest, you may be overpaying to suit your monetary. It will save you money throughout the refinancing so you’re ready in order to a loan having a great straight down costs.

The newest Impact Interesting Rates

But a few tenths regarding a percentage point difference in notice costs can indicate lots of money stored due to enough time you possess your residence. Let us check an illustration. Suppose you have home financing that have $150,000 maintained the dominating equilibrium. You have got a predetermined rate regarding 4.5% and you will 15 years remaining oneself title. Today, thought you can observe one to home loan will cost you is straight down now than just you happen to be to purchase. A loan provider proposes to re-finance the borrowed funds with the exact same requirements so you’re able to an active 4% rate of interest.

For individuals who keep the newest investment, you’ll end up investing $56, within the notice once your become paying the loan. By firmly taking this new refinance, you pay $44, within the appeal before you could private your property. Merely fifty % away from a portion area adaptation saves you more $six,000.