Loan providers try reduced just starting to lay the home loan sale back for the to the markets, but rates are actually higher than ahead of.

More step one,five hundred mortgages was withdrawn during the last day of September, leading to average pricing into the a couple-seasons repairs ascending to help you a great 14-year large.

Here, we describe as to why finance companies pulled its income and outline the least expensive mortgage loans nonetheless designed for household moving services and you can earliest-big date buyers.

Which newsletter provides 100 % free money-relevant posts, along with other details about And this? Classification products and services. Unsubscribe anytime. Important computer data would-be processed prior to our Online privacy policy

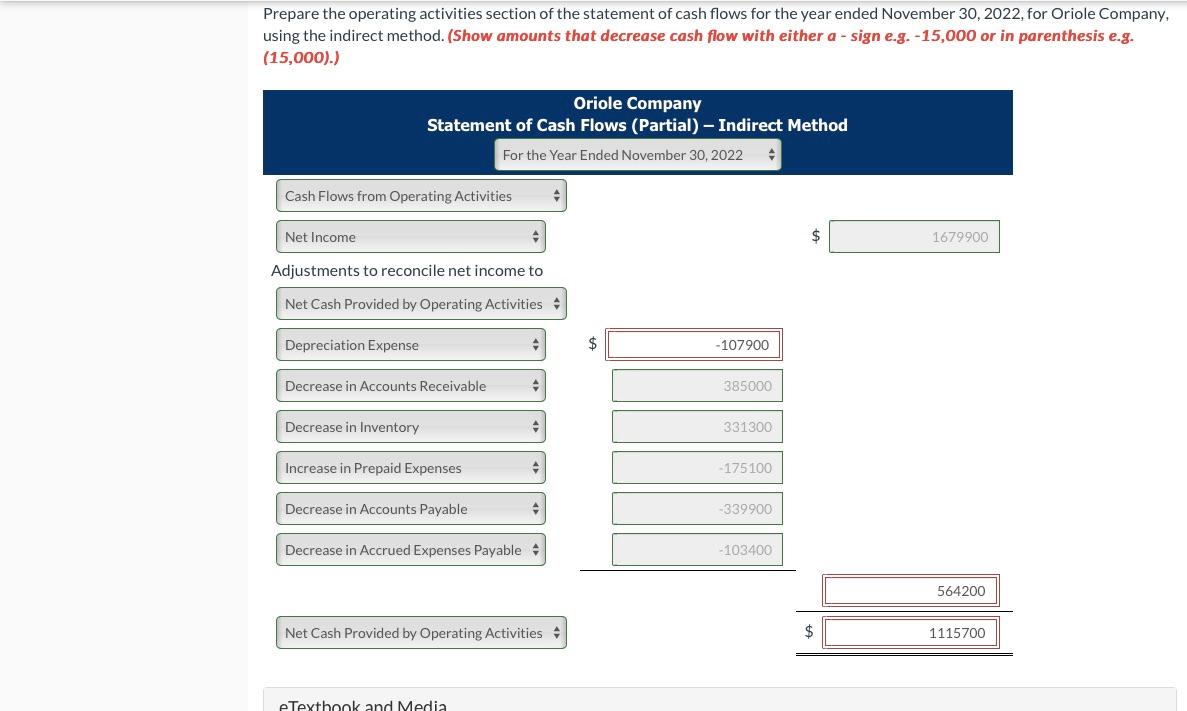

A lot more than, we’ve got indexed the fresh works with the least expensive very first cost. This gives a indication of the speed you happen to be capable of getting, with respect to the measurements of their put, but before opting for a package you will need reason behind upfront charges.

Certain lenders charges charge as high as ?step one,999 on their reduced-rates business. By the recharging higher costs, loan providers can offer best pricing and you will recoup the new shortfall someplace else.

Banking institutions are not fees charges such ?999, ?step one,499 otherwise ?step one,999, however play with percentages alternatively – for example 0.5% of your own complete loan amount. When you’re credit a larger share, this might be so much more high priced.

You are able to usually need to pay a made of 0.2%-0.5% to track down a fee-free deal. Sometimes https://paydayloanflorida.net/florida-ridge/, this will repay. Particularly, as much as possible rating a mortgage at 5.5% having an effective ?999 percentage, otherwise 5.6% no commission, the latter will be reduced along side fixed title.

Whenever you are not knowing about which type of bargain to choose, a mortgage adviser should be able to analyse marketing centered on its true rates, taking into account prices, costs and you may incentives.

Will you be concerned with your bank account?

Answer a few questions and we’ll make you a personalized checklist of qualified advice to help you control your money.

How long any time you develop your own mortgage having?

One of the greatest inquiries with respect to mortgages is: based on how a lot of time any time you protected your rate?

Borrowers most often treatment for both two or 5 years. Five-year business was shortly after a great deal more costly, in extremely days it’s now in reality less to fix to own extended.

Five-season fixes usually feature large early cost fees, for example you might be billed thousands of pounds for many who ple, for people who move house plus don’t import they into the new property).

With this thought, it’s important to consider their medium and you will long-name preparations prior to buying a fixed term.

And therefore? Money Magazine

Find a very good product sales, avoid cons and you will construct your offers and expenditures with our specialist advice. ?cuatro.99 a month, terminate whenever

What happens second from the home loan markets?

Homeowners to the varying-price profit (for example tracker mortgages ) try most confronted by feet speed alter, but those people going to the termination of their fixed terms are now planning to run into greater pricing when they remortgage.

Odds are mortgage cost continues to rise in brand new temporary, which have subsequent feet rate hikes around the corner.

Should your repaired title is on its way so you’re able to an end, it’s as important as previously so you can remortgage just before are moved on with the lender’s simple adjustable price (SVR). If you lapse on to your lender’s SVR, the speed will go up when the beds base speed does.

And that? Money Podcast

Towards the a current bout of this new And therefore? Currency Podcast, i discussed just what falling value of the newest lb and you will ascending rates mean for the money – like the influence on mortgage loans and family rates.