While this personal debt could well be taken into consideration having financial affordability checks, there is nothing that claims that that have an educatonal loan often avoid you against providing a mortgage

- Pro Stuff

- Very first time Buyers

As the 2020 pandemic and you will after that personal best online tribal loans distancing procedures could have hindered the new public experience normally with the school life, the newest significant university fees costs will still be a comparable. Student youngsters already pay up to ?nine,250 a-year to look at its programmes, even though we have witnessed speak of government slashing costs in order to send better value getting students’, the latest fees were frozen up until 2022. Why does racking up that it level of debt apply at students’ economic wellness later down the road, plus particularly, which are the implications when it comes to delivering a home loan? This article have you protected.

There’s nothing to declare that with an educatonal loan will avoid you against providing a mortgage. While this loans would be considered to have lender cost inspections, your circumstances overall should determine their qualification.

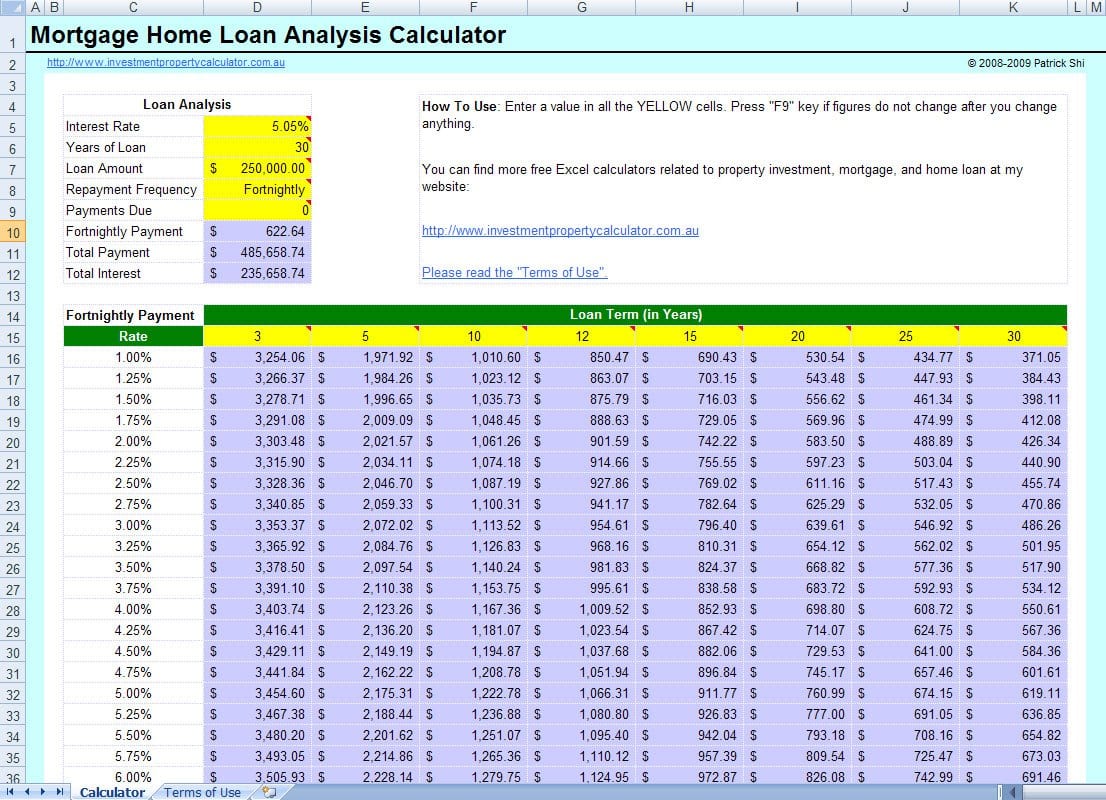

As with any home loan, there are a number of things within gamble that may perception your application. How big is your put, credit score, earnings, and just how much your own student loan and any other expenditures set you straight back each month, are merely some examples.

Even though it tends to be more complicated locate a base on to the home hierarchy if you have a student loan, at some point loan providers simply want guarantee to afford a mortgage at the top of their most other outgoings.

Addressing a broker can be the most practical method regarding guaranteeing your begin the procedure properly, and you will bag more favorable price for the private situation.

Which are the influences of student loans on the mortgage applications?

Thankfully you to definitely, even if loan providers will need student loans into account whenever undertaking its testing, this type of personal debt does not appear on your own credit history and will not adversely impact your credit score like many kinds of borrowing do.

Yet not, it is a essential let your bank determine if you really have an educatonal loan, plus the following recommendations is going to be declared in your mortgage software:

- Exactly how much can be your student loan fees monthly?

Just how much you pay out a month on education loan financial obligation might have a huge impact on extent you are able to borrow, therefore it is vital that you include that it the rest of the month-to-month outgoings.

Student loan costs show up on the PAYE staff payslips automatically together which have taxation and you may national insurance efforts, that are deducted instantly relative to your revenue. If you are thinking-operating, student personal debt try paid down from tax system into the much this new same manner.

What you are remaining which have once these write-offs is the online spend, which is the contour lenders uses in affordability calculations.

If the PAYE income try changeable because of bonus otherwise payment, the lending company uses an average of the very last 90 days student loan repayments since a relationship.

- How much of the education loan have you got remaining so you can repay?

Just how much you may have left to repay of one’s education loan is even of interest in order to lenders, just like the as with every kinds of a great loans, they want to know the full amount owed and exactly how a lot of time it may need one pay it off.

Does an educatonal loan apply to your credit reports?

Student education loans don’t appear on your own credit reports, neither perform it impression your credit score, causing them to different from other variety of borrowing. Having said that, which have one can still perception your financial reputation in which providing a mortgage is worried.